One of the most important tasks in running a small business is managing finances efficiently. A significant financial area is invoicing customers for the products or services provided. However, managing invoices, whether it’s creating invoices or tracking payments, can be time consuming and tedious, especially for small businesses. That’s where free invoicing software comes into play - you can streamline the process and focus on other important aspects of your business. As ideal as it is to use invoicing software, integrating it with IFTTT, an automation service that lets you connect and integrate over 1000 services, can take it to the next level. Using IFTTT can help business owners streamline their invoicing process which can help save time and effort, giving the ability to focus on other critical aspects of their business.

In this blog post, we will discuss the importance of free invoicing software and explore the top 4 best free invoicing software options for your business.

BTW IFTTT is a small business automation platform. Join for free today!

Table of Contents

- Why invoicing softwares are beneficial for your business

- Wave

- Intuit QuickBooks

- PayPal

- Zoho Invoice

- How to decide which software is best for your business

- Upgrade your invoicing software with IFTTT

Why invoicing softwares are beneficial for your business

Invoicing software is a beneficial tool for any business that is looking to streamline the billing process, minimize errors, and improve cash flow. Let’s take a closer look at each of the benefits.

Efficient time management One of the significant advantages of invoicing software is that it saves time. The software automates the process of creating invoices, which means you'll no longer spend all your time and effort creating and sending out invoices to your clients. Additionally, invoicing software contains pre-built templates that you can customize to meet your needs. As a result, you can quickly send out invoices with just a few clicks of a button.

Minimized errors Invoicing software reduces the chances of errors. Manually creating invoices can cause errors, such as incorrect dates, wrong amounts, or misspellings that can cause significant problems down the line. Invoicing software automatically calculates the correct amounts and dates, automatic calculation of taxes, and control of overdue payments, reducing the chance of errors. You can also set up recurring invoices, which helps ensure that you invoice the same customers on a regular schedule, reducing the chances of errors.

Improved cash flow Invoicing software can help you improve your cash flow. The software allows you to get paid more quickly by sending out automatic payment reminders to your clients, which can also reduce payment delays and help you stay on top of client billing. You can also choose to accept online payments, allowing your clients to pay you instantly. Additionally, invoicing software can help you keep on top of your accounts receivable, ensuring that you know who owes you money and when.

Wave

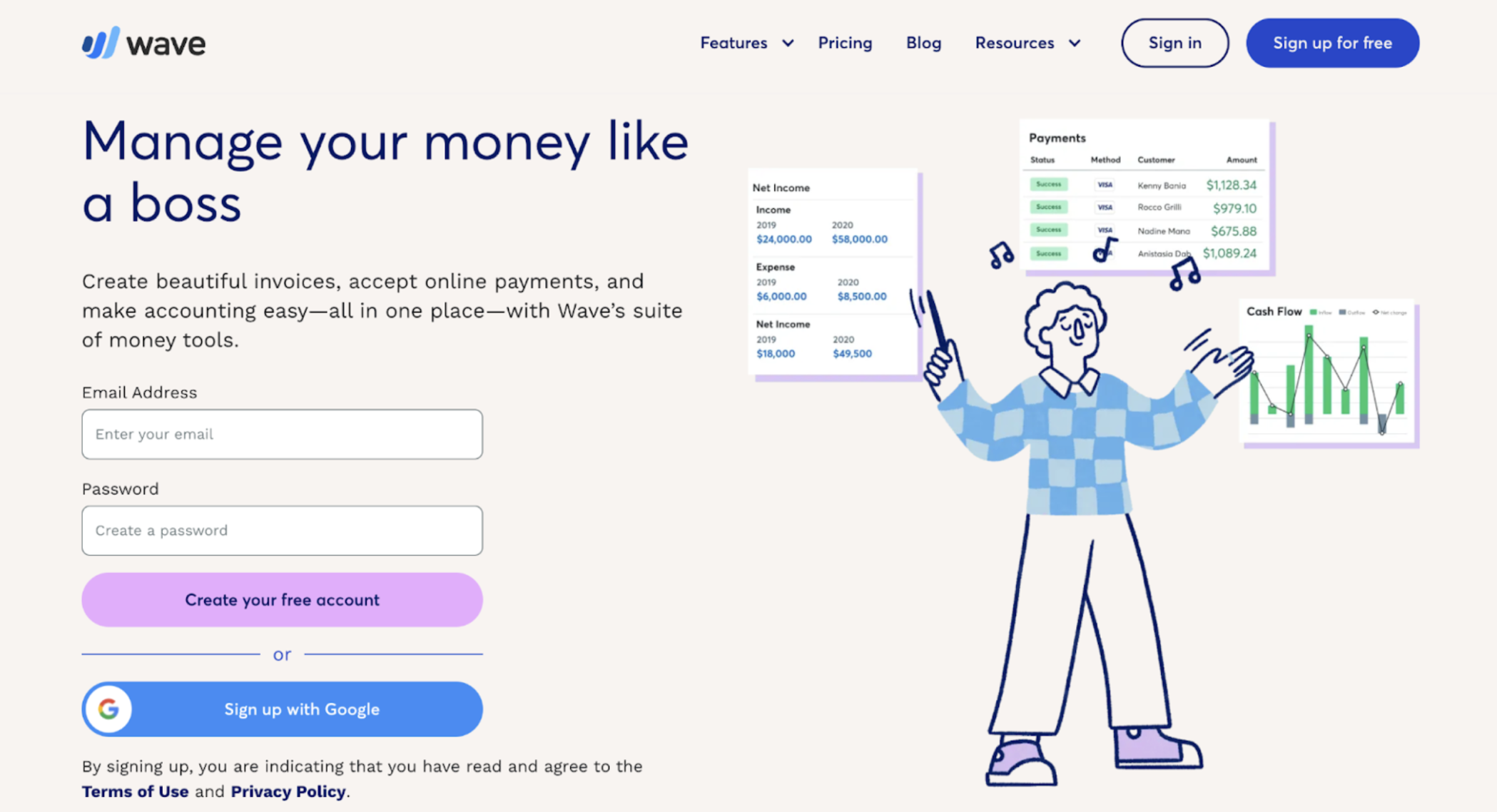

Wave is an all-in-one financial management solution for small businesses and freelancers around the world. It is designed with small business owners in mind who are on a tight budget with an easy-to-use platform. Let’s take a deeper dive into the features they provide:

Features

Invoicing: Creating invoices is easy and quick with a simple tap on ‘Create a new’ and ‘Invoice.’ You’ll be able to choose from various templates and customize it to tailor their brand and requirements. On top of that, you can create recurring billing for repeat customers so it is ensured that timely and consistent payments are sent.

Payments: Wave accepts payments through various online payments by bank deposit, credit card, and Apple Pay. As a result, customers can get paid within business 1-2 days with fees as low as 1%, making it convenient for both parties.

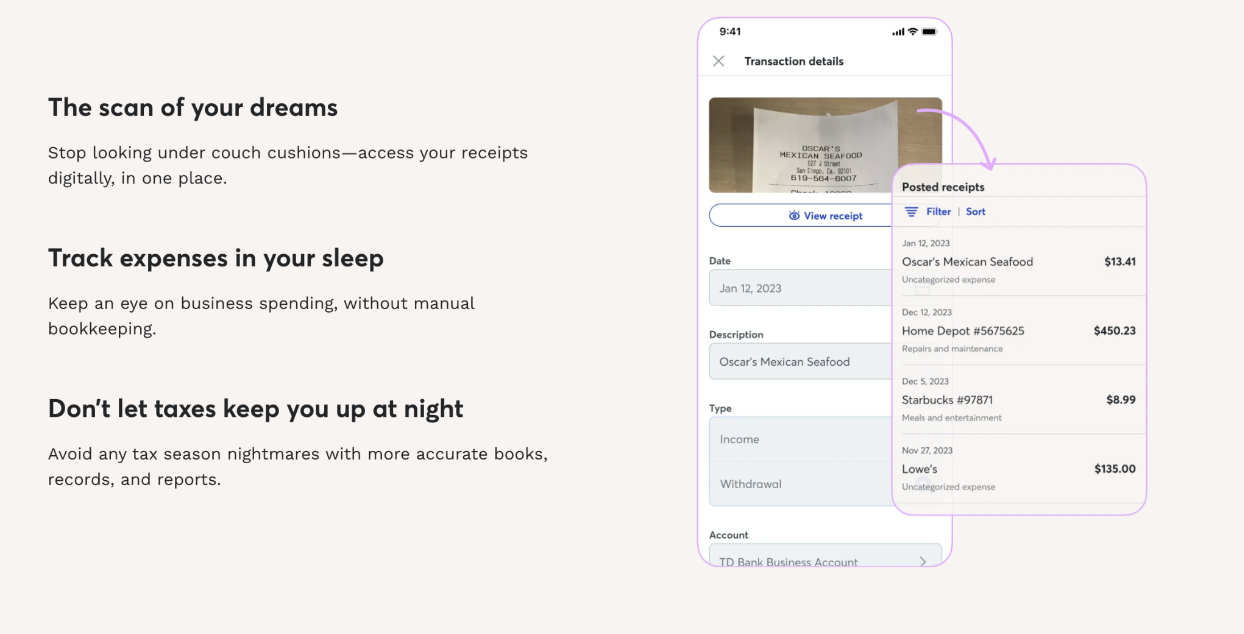

Mobile receipts: Wave utilities optical character recognition (OCR) technology so users can scan receipts and import data quickly. Users can scan unlimited receipts and bulk-import up to 10 receipts at a time, making it convenient and efficient. In the end, scanned receipts and data automatically back up scanned receipts and data to the cloud.

The use of OCR technology serves the purpose of aiming for efficiency and accuracy, saving users the time and effort in managing their finances.

Payroll: Wave has a payroll software that is efficient and easy to run. Here are the features of its payroll software: - Automatically pay and file your state federal taxes for businesses that are in AZ, CA, FL, GA, IL, MN, NC, NY, TX, TN, VA, WI, AND WA. - Generate W2 and 1099 forms for tax season. - Have direct deposit set up. - Employees have the ability to safely access their banking information, W2, and pay stubs. - Seamlessly integrates with Wave account, reducing the effort and time you spend on manual bookkeeping.

Integrations: Wave can be integrated with third-party services which will soon include IFTTT! We’re currently working on launching this service that will be out soon, which will open up the ability for Wave users to better manage their invoicing processes. Stay tuned!

Pricing:

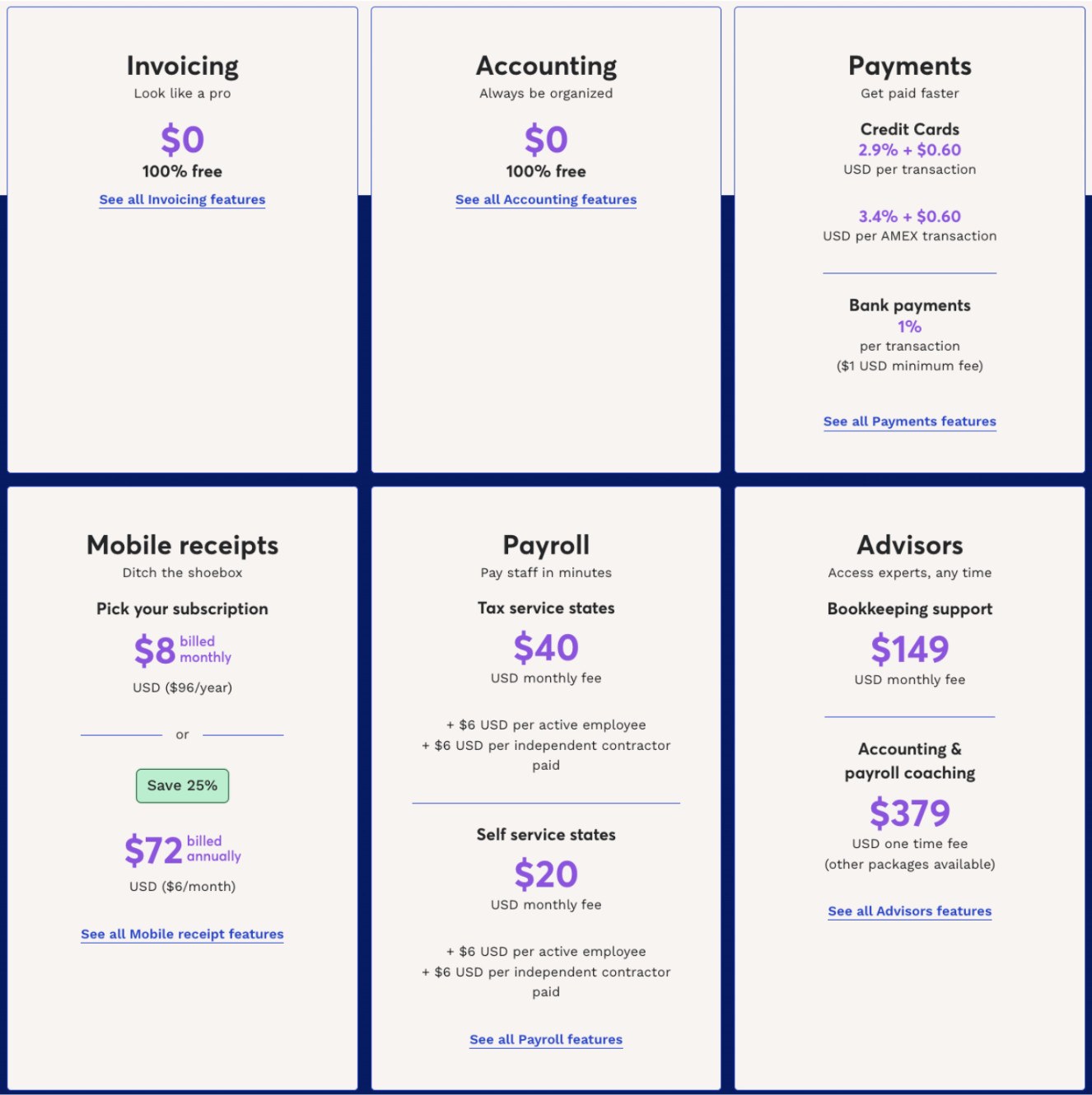

Wave Invoicing software is free to use, and you don’t have to pay any subscription fees or ongoing charges. You can create unlimited invoices, estimates, and customers, and access reporting tools for free. Additionally, their Account software is free to use if you are interested in that.

However, there are a few premium features, including automatic payment processing and recurring billing, that you can avail of by paying a transaction fee. If you choose to use the payment processing feature, Wave charges a fee of 2.9% + 60¢ for credit card payments or 3.4% + 60¢ for AMEX transactions and 1% per ACH payment. Wave also includes other subscriptions like mobile receipts, payroll, and advisors that you can learn about here.

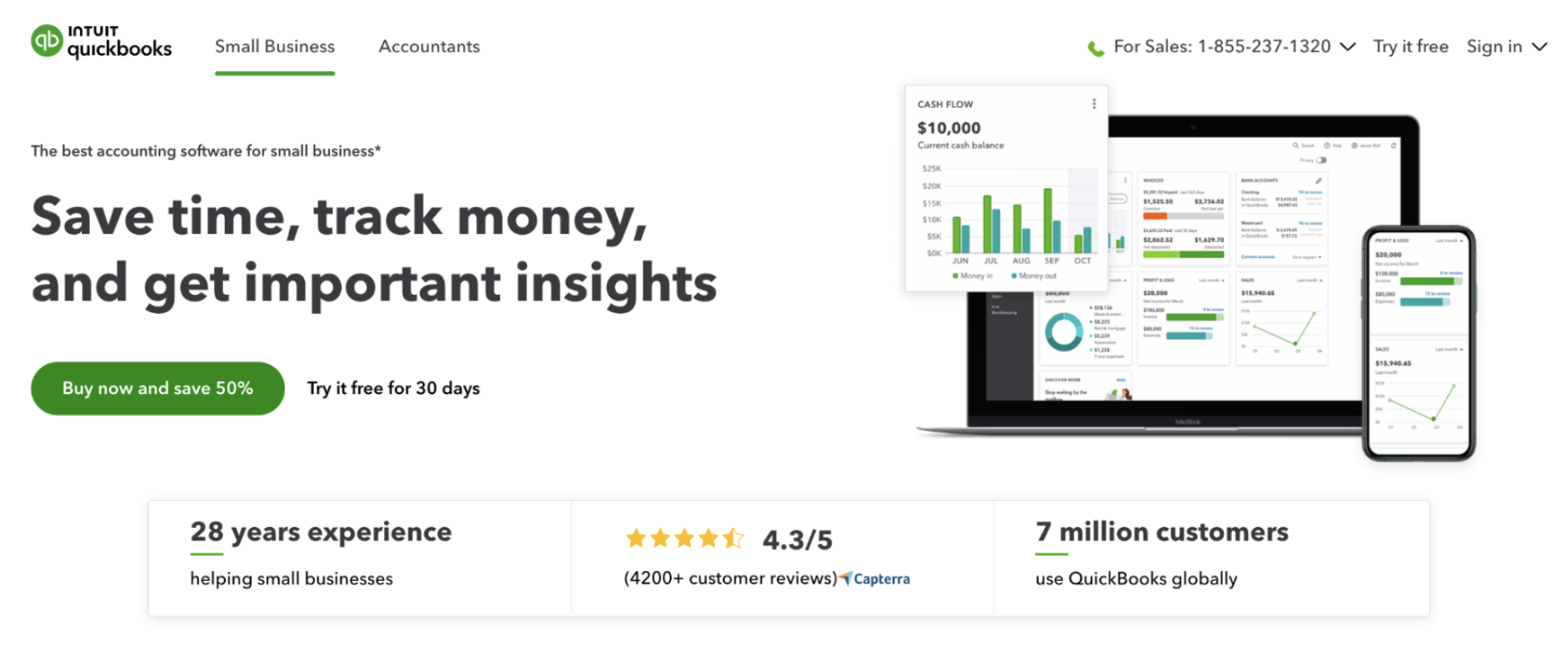

Intuit QuickBooks

Intuit QuickBooks is an all-in-one business software designed to help you manage your business finances with ease. It takes control of your business by saving time on bookkeeping and paperwork with its range of tools including invoicing, payroll processing, financial reporting and more.

Features

This software includes the basics of what you expect out of an invoicing software like customizable invoices, invoice templates, tracking and management, online payments and more, but they have 3 features that stand out and can enhance your invoicing experience:

Receipt capture: Intuit QuickBooks uses OCR technology where users can snap photos of their receipts on their phones and link them to their expenses.

App integration: This software integrates with different third-party applications, including e-commerce stores, payment-processing software, and even project management platforms. A huge plus is that Intuit QuickBooks integrates with IFTTT, which leaves even more space for extensive automations and customized workflows that will enhance your invoicing software experience. For example, when a Google Form is filled out, add user information to QuickBooks as a customer. Check out more of our Intuit QuickBooks integrations:

-

When new customer is created in Quickbooks send yourself an email

-

When I receive a payment in Quickbooks, post to a Slack Channel

-

Add new QuickBooks Online invoices to Google Sheets

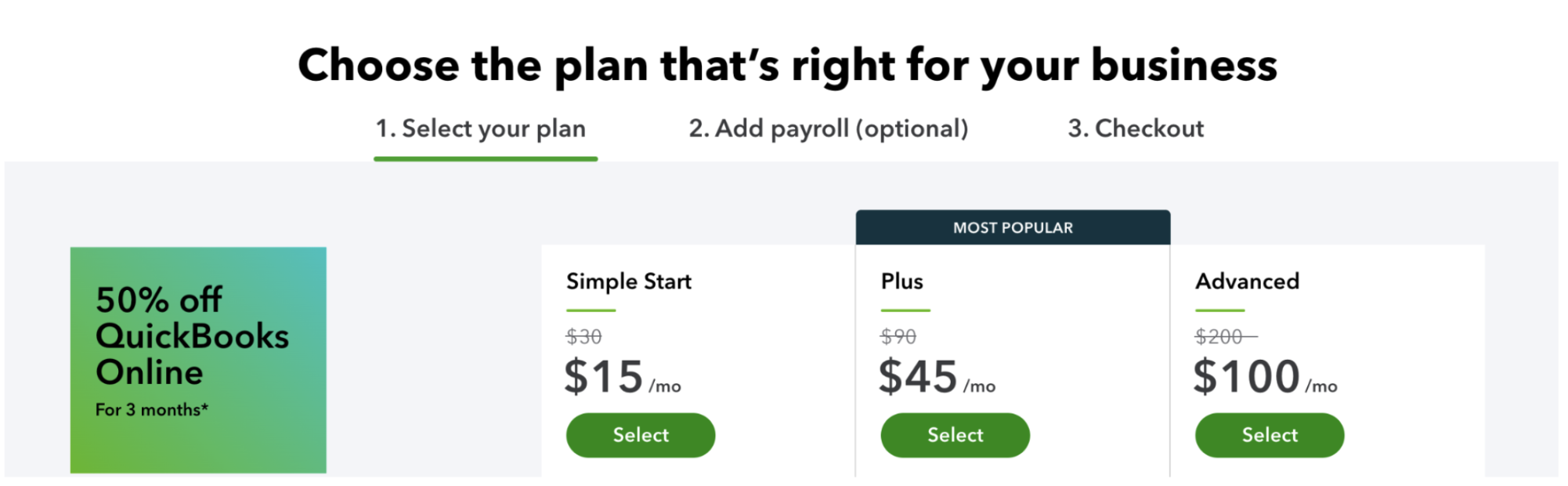

Pricing

Although Intuit QuickBooks is not entirely free, you can try it free for 30 days to see if it’s a service worth using for your business. offers three plans that users can choose from. Let’s dissect each of them.

Simple Start ($30/month): This is their most basic plan and is perfect for those who are just starting out and want simple features. It includes: free guided setup, income and expenses tracker, ability to capture and organize receipts, mileage tracking, unlimited invoice and accept payments, cash flow management, ability to run general reports, 1 sales channel, manage 1099 contractors, track sales and sales tax, and create and send estimates.

Plus ($90/month): The Plus plan includes everything in the Simple Start plan, in addition to comprehensive run reports and all sales channels.

Advanced ($100/month): The Advanced plan includes everything in the Plus plan, along with batch invoices and expenses, business analytics with Excel, customize access by role, enhanced custom fields, ability to manage employee expenses, exclusive app integrations, revenue recognition, ability to automate processes and tasks, 24/7 support, and on-demand online training.

PayPal

PayPal Invoicing provides a secure (emphasis on secure) and straightforward software that allows you to create and send invoices to your customers. It is accessible via the web or through the PayPal mobile app. You can create an invoice anytime and anywhere, making it convenient and efficient.

Creating a PayPal Invoice is a straightforward process. Once you log in to your PayPal account, select “Invoicing” from the menu. Then, click on “Create an Invoice.” From there, you can fill in the relevant information, such as the customer’s email address, the item or service description, and the price.

There are several benefits of using PayPal Invoicing for your business. First, PayPal Invoicing is secure. PayPal encrypts your transactions, ensuring that your customer’s sensitive information is protected. Another benefit is it offers various payment options, including credit card, debit card, and PayPal balance, giving your customers flexibility and convenience.

PayPal is a great option for those who want to effortlessly create an invoice, but it lacks features like comprehensive information of clients.

Pricing

PayPal Invoice fees vary depending on the country, currency, and payment method selected. In general, the fee for receiving payments using PayPal, Venmo, and Pay Later is 3.49% + $0.49 per USD transaction and for debit and credit cards is 2.99% + $0.49 per USD transaction. However, if you’re receiving payments from international clients or using a different currency, you may be charged additional fees ranging from 0.5% to 4% per transaction.

Zoho Invoice

Zoho Invoice is a completely free online invoicing software aimed for small businesses and freelancers to use. One benefit of using Zoho Invoice is how it streamlines the invoicing process. The software has customizable templates for invoices, estimates, and other types of billing documents. On top of that, it gives users the ability to send invoices in different currencies and make base currency adjustments. Additionally, the software's automatic reminders help ensure timely payments from your clients, reducing the need for you to follow up with them repeatedly.

Another benefit of using Zoho Invoice is its powerful dashboard. In the dashboard, you can see real-time data about your invoices, estimates, and payments. You can also view charts to better understand trends in your business's invoicing and payment cycle. The dashboard also provides a timeline of your invoicing history, making it easier to track client interactions over time.

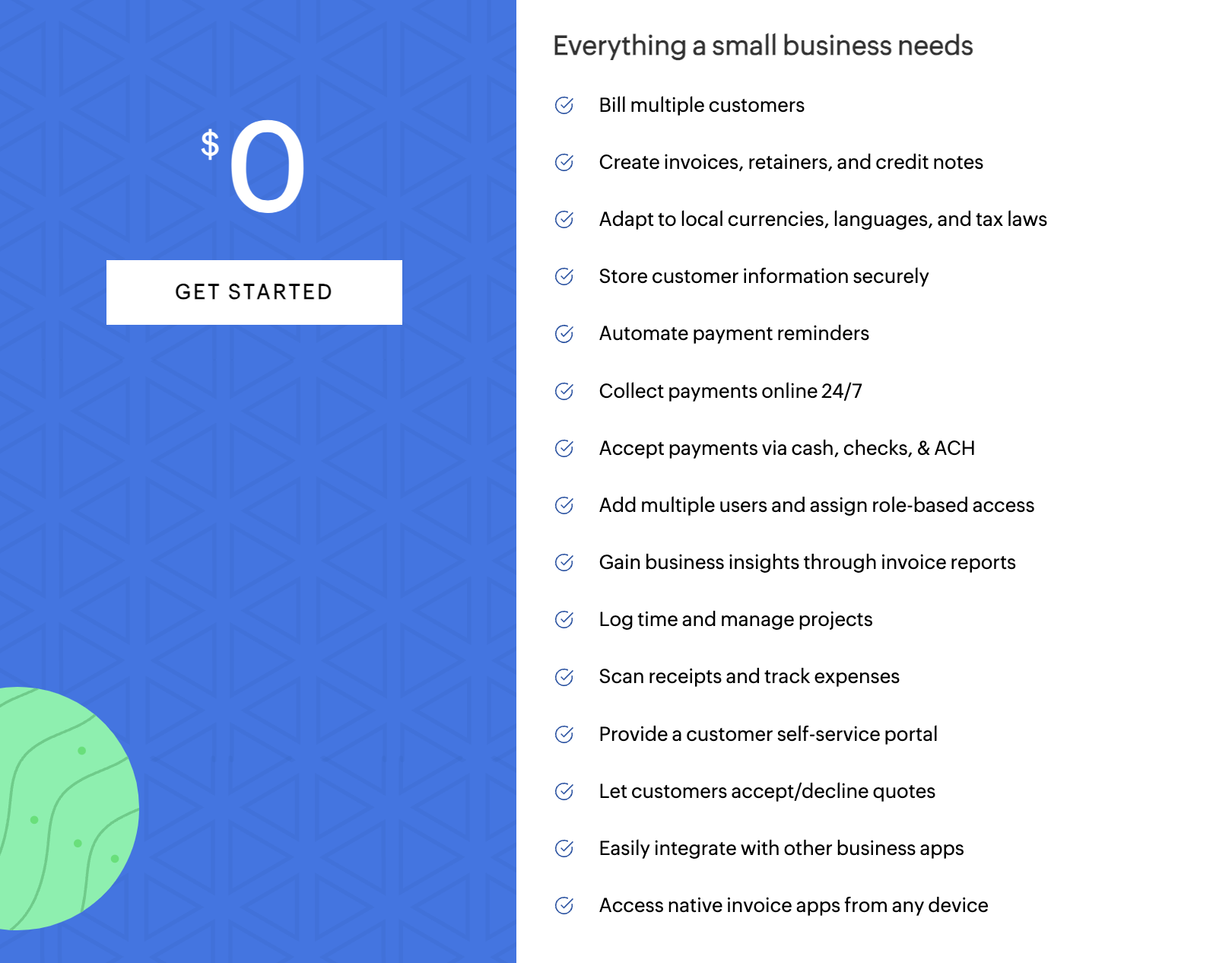

Pricing

Zoho Invoice is completely free of charge! Even with all the robust features, you can still use Zoho invoicing for free. It has everything a small business needs: bill multiple customers, ability to create invoices, retainers, and credit notes, ability to store customer information securely, gain business insights through invoice reports, customer self-service portal, integrations, ability to scan receipts and track expenses, and more.

How to decide which software is best for your business

Choosing the best free invoicing app for your business can be overwhelming and you may still be having trouble deciding on which invoicing software to use. You want a software that is user-friendly and works seamlessly with your business needs. Let’s dive into some factors to consider when choosing the perfect invoicing software for your business.

Feature sets: The features and functionality of an invoicing software are essential. Look for software that allows you to create, send and track invoices easily. You should also consider software that has invoicing automation to save time and effort. Other features that can be valuable include integrated payment processing, automatic reminders, late payment fees, and invoice customization options. Additionally, you can opt for software that offers expense tracking, time tracking, and estimates, which may be useful for your business operations.

Ease of use: Another important factor to consider is the ease of use of the invoicing platform. You want to make sure that you and your team can quickly and easily generate invoices without a steep learning curve. Additionally, consider the user interface and if it is easy to navigate.

Customer support: Don’t forget to look into the customer support options of any software you are considering. This is particularly important if you or your team have limited tech savvy. With good customer support, you don't have to worry about being left in the dark in case of technical difficulties or software glitches.

Data security: Data security is an essential factor to consider when selecting invoicing software. Establish the software's security measures to ensure your business data is safe and secure. You should look for software that uses encryption technology and has two-factor authentication. Also, ensure that the software runs regular backups and updates and provides secure storage for your sensitive business data.

Integration with other business tools: For optimal productivity, your invoicing software should integrate with other business tools you already use, such as accounting software, CRM, or project management software. Integration with other software can help you streamline your business processes and reduce the workload of your employees.

Upgrade your invoicing software with IFTTT

There are many invoicing softwares out there to choose from to help you streamline your invoicing process. It is a game changer for businesses, but what makes it even better is by integrating your invoice software with IFTTT. Iit not only saves you time and effort, but also provides you with more flexibility and control over your invoicing process. There are many use cases for IFTTT in invoicing. Some examples include updating your accounting software with invoice data, sending a notification to your team members when a new invoice is created, and much more. So, what are you waiting for? Automate your invoicing software with IFTTT for free today!